tax act stimulus check error

Latest on push for one group to get 4th stimulus check If youre getting ready to file your 2021 tax return click here for steps you can take to make filing easier. First double-check that you qualify for a stimulus check.

Never Got A Second Stimulus Payment Here S What To Do Next And Other Faqs Forbes Advisor

Child tax credit payments could act as stimulus for retailers as soon as this month.

. This decision was made after days spent advocating for our customers and pushing the IRS to rightfully send these much-needed stimulus dollars quickly to our customers. Married couples who file jointly and earn less than 150000 will receive 2400 and families will also get 500 per child. Due to a stimulus payment adjustment which may result in your refund being less than you expected.

How to Claim a Missing Payment. You will get an official IRS letterreport explaining the actual offset and adjustments to your tax return and details on how to appeal this action but likely it will delay you getting your refund. Resident alien in 2020 are not a dependent of another taxpayer for tax year 2020 and have a social security number valid for employment that is issued before the.

If you do NOT check the box no bank account information will be sent and you will receive your stimulus payment as a check from the IRS. But those who filed a tax return in 2021 and claimed the Recovery Rebate Credit might have a problem. Thats dictated by the PATH Act.

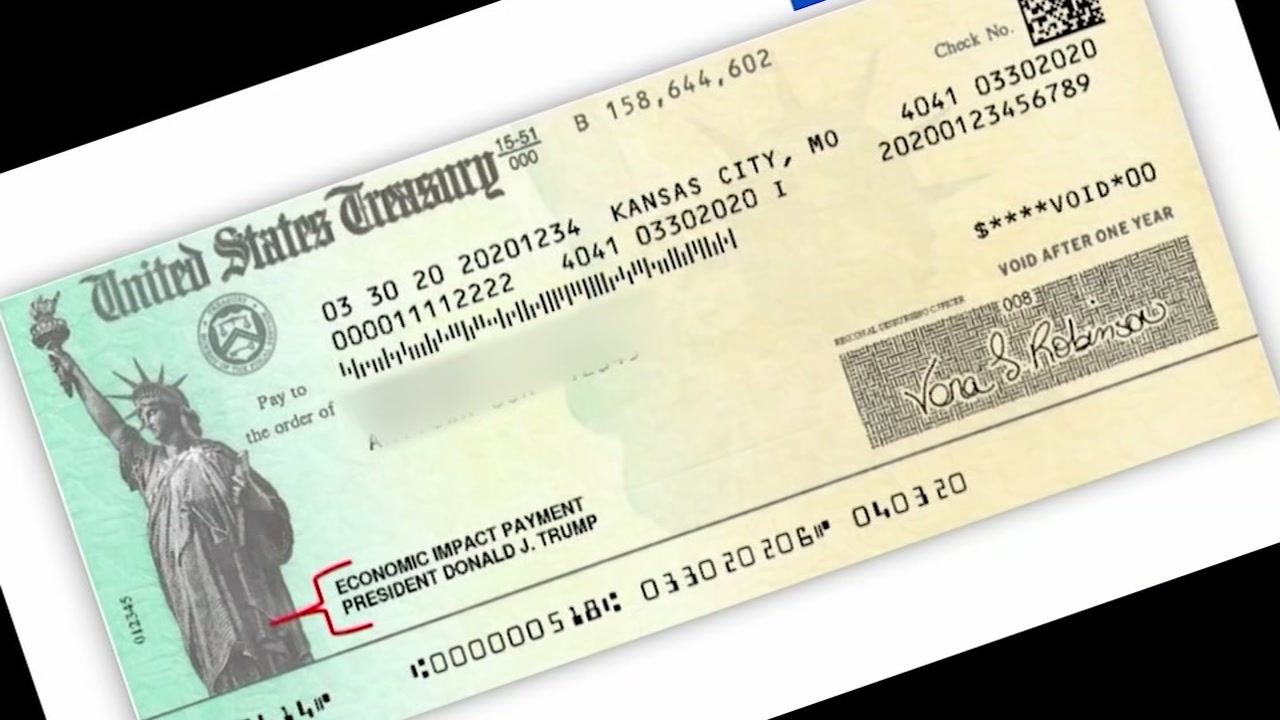

Taxpayers who have filed US tax returns in 2018 or 2019 have already. 10 2021 we announced the IRS has committed to reprocessing stimulus payments directly to our customers impacted by the IRS payment error. Stimulus payments erroneously sent to closed or incorrect bank accounts by the IRS are being redirected according to tax preparation companies affected by the mistake.

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didnt get an Economic Impact Payment or got less than the full amount. You can no longer use the Get My Payment application to check your payment status. The latest stimulus payments as part of President Joe Bidens American Rescue Act sent 1400 checks to Americans.

Turbo tax Not calculating stimulus correctly. So I just filed my taxes online for free via tax act which IRSgov sent me to and one of the questions was did you receive a third stimulus for 1400 for a moment I was confused and didnt know there was a third stimulus so I said no. 1909 ET Dec 10 2021.

This IRS error caused some people to not. There are no exceptions or alternative interpretations period. Tax Topic 151 means that youre getting a tax adjustment or offset eg.

To claim the 2021 Recovery Rebate Credit individuals will need to know the total amount of their third-round Economic Impact Payment including any Plus-Up Payments they received. The amounts you received as stated in your post would be correct if one of your. If the return includes errors or is incomplete it may require further review while the IRS corrects the error which may slow the tax refund.

The payments will be. Delete state return if you have one. Our bank partner complied immediately to ensure we.

At the end of the 2019 tax filing season the IRS processed 155 million tax returns - many of which qualify for a stimulus check. Hundreds of taxpayers were notified to fix filing errors ahead of the deadline in order to get their 1400 payments. The eligibility requirements for the second stimulus payment are the same as the first round of payments issued earlier in 2020.

Most families received half of the credit in advance via monthly payments last year but theres still more money to be claimed -- 1800 per. I was told because we chose to pay our tax preparation fee out of our 2019 refund the stimulus was deposited into their HR Block bank account instead of. On the screen titled Verify that your bank account information is correct double check your bank account information entries.

No one claiming the ACTC Additional Child Tax Credit or EITC Earned Income Tax Credit has received or will receive a direct deposit before February 15th. You are eligible to receive a check if you meet the income requirements which are an adjusted gross income or AGI of under 99000 if. You gave up US citizenship or renounced a green card in 2019.

A check was issued in the name of a single deceased person - the check was sent in error. If correct check the box. The IRS issued a stimulus payment based on the 2018 tax return information - that payment is an error.

THOUSANDS of stimulus payments were issued this week as the government urged taxpayers to claim their checks by December 23. The correct amount of Recovery Rebate Credit is based on the information in your 2020 return only. The first stimulus package included 1200 in direct payments and the next one sent 600 to Americans.

The expanded child tax credit for 2021 isnt over yet. Monthly child tax credit payments will start on Thursday and run through December. Upon realization of this error the IRS instructed financial institutions to return the funds to them which is required.

You are supposed to pay it back. The IRS deposited my Economic Stimulus Payment into an account at the Bank of Republic because I paid Tax Act for the filing of this return with my return. I called the IRS when I found out I shouldve received my stimulus payment by.

Please verify that both of your dependents are under age 17 on your 2020 tax return and your income is showing below 150000. 1907 ET Dec 10 2021. This is not a new thing weve been dealing with this since 2016.

Its a monumental task with a. The IRS on February 14 said tax returns with errors involving the third stimulus check which are missing information or which have suspected fraud or theft could take up to 90 to 120 days to resolve. It told me my tax refund and the 3rd stimulus of 1400.

In short the CARES Act is a stimulus package which aims to support workers earning less than 75000 per year with a one-time payment of 1200. After completing it I e-filed my taxes. The IRS sent some of the stimulus payments to inactive or closed bank accounts.

According to the IRS a taxpayer is eligible if you were a US.

Stimulus Checks Latest Guidance On Checks Received In Error Wegner Cpas

Stimulus Check Payments Nursing Home Residents Center For Elder Law Justice

Where S My Third Stimulus Check Turbotax Tax Tips Videos

Rejected Return Due To Stimulus H R Block

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

Irs Stimulus Checks Frustrated Americans Left Waiting For Payments As Internal Revenue Service Sends Funds To Wrong Accounts Amid Coronavirus Pandemic Abc7 Chicago

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Nonresident Guide To Cares Act Stimulus Checks

Stimulus Check Problems What To Do If Check Goes Into Wrong Account Irs Get My Payment Portal Shows Error Abc7 New York

Important Updates On The Second Stimulus Checks Taxact Blog

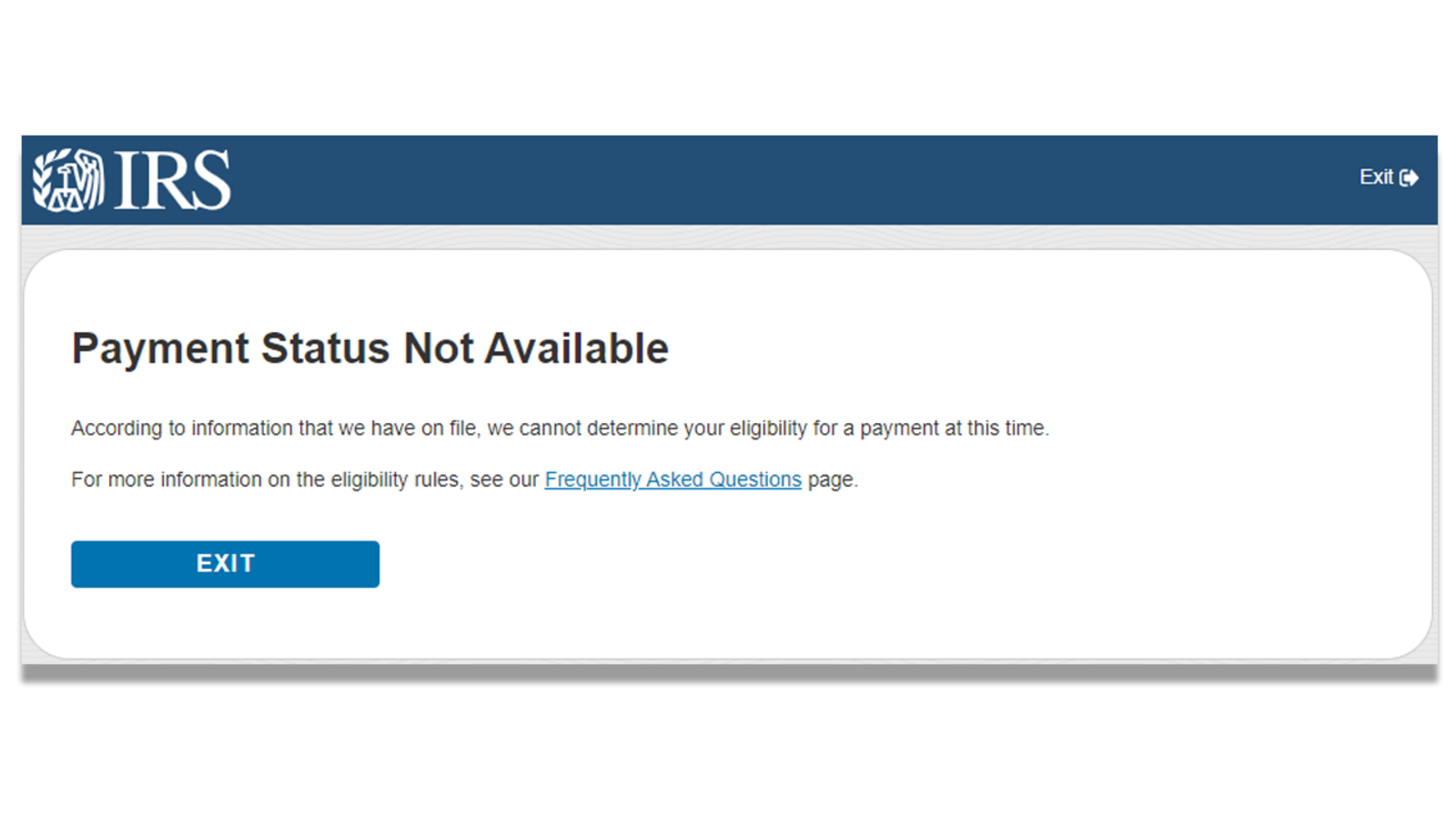

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc11 Raleigh Durham

Irs Admits Mistake In Noncitizens Receiving 1 200 Coronavirus Stimulus Checks Npr

The Irs Is Still Issuing Third Stimulus Checks We Ve Got Answers To Your Faqs Forbes Advisor

Coronavirus Stimulus Checks Sent To Millions Of Dead People Treasury Department Wants Them Back Abc7 San Francisco

Stimulus Check 2021 Irs Says Letter From White House Outlining Stimulus Payments Not A Scam Abc7 Chicago

Second Stimulus Check Problems Payment Status Not Available Error On Irs Website Means Some Need To Claim 600 On 2020 Tax Returns Abc7 San Francisco

Irs Stimulus Check Portal Payment Status Not Available Error What Does It Mean Abc11 Raleigh Durham

Important Updates On The Second Stimulus Checks Taxact Blog

American Rescue Plan What Does It Mean For You And A Third Stimulus Check Turbotax Tax Tips Videos